Your Path to Ownership!

0% Financing Available — Invest Today, Pay Smart

Qualified customers can take advantage of 0% financing options, allowing you to invest in modern production technology while preserving capital for daily operations. The process is straightforward, transparent, and tailored to the real needs of manufacturing companies operating in the U.S. market.

Upgrade your production capabilities today and let your equipment start working for you from day one—while your budget stays comfortably in control.

Financing available for qualified buyers.

Affordable Payment Plans and Quick Approvals

Tax Benefits and Long-Term Savings

Apply Now and Start Growing Your Business Today!

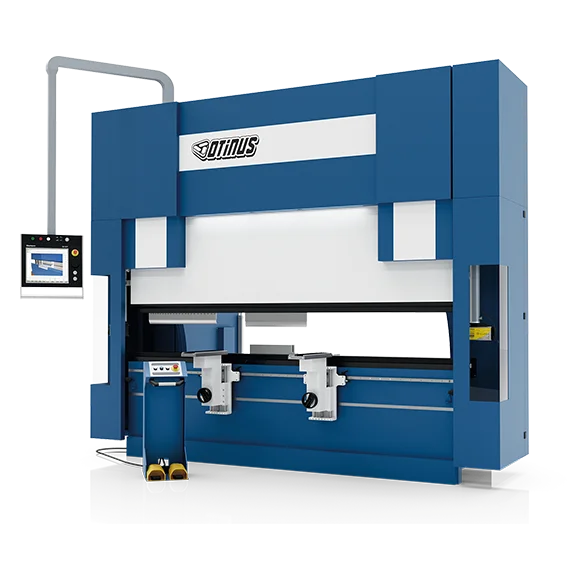

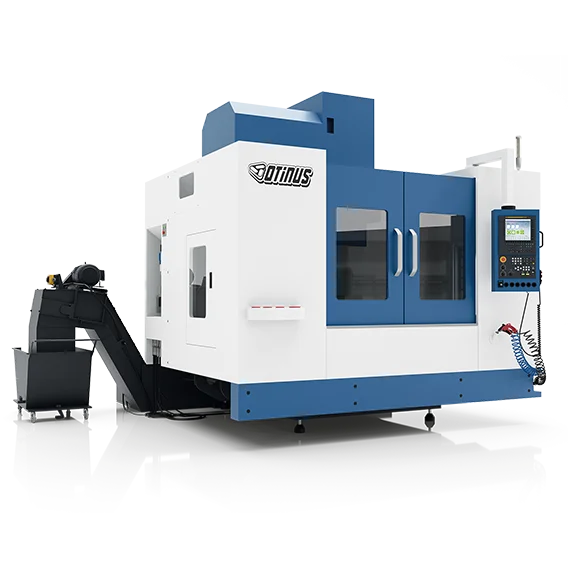

Choose now from machines available immediately

Nothing’s holding you back now. Special financing offers and in-stock machines ready for instant installation.

Frequently Asked Questions

We understand that the decision to invest in a new machine is an important step for any company. That is why we have prepared answers to the most frequently asked questions regarding leasing, rental, and other financing options offered by Otinus Finance.

Here you will learn, among other things, how the financing process works, which documents are required, who can take advantage of the offer, and how quickly you can start your investment. All of this is designed to make your decision easier and help you begin your growth journey without unnecessary formalities.

Only basic information about the company owners and the declared revenue from the last two financial years are required. The process does not require submitting full financial documentation or certificates from the Social Insurance Institution (ZUS) or the Tax Office.

From submitting the data to receiving the decision usually takes only a few hours, which significantly speeds up the entire financing process.

Financing is available even from the first day of operating a business.

We have the knowledge and practical experience to structure applications in a way that supports obtaining a positive financing decision.

We accept payments in US Dollars

We offer several flexible financing options:

– Traditional leasing,

– Short-term rental,

– Flexline financing facility,

– Cash purchase (self-financing),

– Leasing loan.

In most cases, the initial payment is made to Otinus, while the remaining payments are made in accordance with the terms of the leasing agreement.

Of course. We provide full support in arranging leasing—we cooperate with trusted leasing companies.

Contact us to receive a personalized financing offer.

Yes. We cooperate with financing institutions that do not verify clients in these databases.

No. We cooperate with entities that do not verify income.